Handbook For When It Just Doesn Add Up: A Comprehensive Guide to Understanding and Addressing Financial Discrepancies

In the realm of personal finance, accuracy is paramount. However, even the most meticulous individuals can encounter situations where their accounts don't seem to balance. Financial discrepancies can arise from various sources, leaving you bewildered and frustrated. This handbook aims to provide a comprehensive guide to understanding and addressing these imbalances, empowering you to regain control over your finances.

4.2 out of 5

| Language | : | English |

| File size | : | 8086 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 458 pages |

Common Causes of Financial Discrepancies

Before delving into troubleshooting, it's essential to identify the root causes of financial discrepancies. Here are some common culprits:

1. Human Error

Despite our best efforts, mistakes can happen, particularly during data entry or calculations. Double-checking your transactions and reviewing your account statements thoroughly can minimize this issue.

2. Fraudulent Activity

Unfortunately, unauthorized transactions and identity theft are growing concerns. Keep your financial accounts secure by using strong passwords, enabling two-factor authentication, and promptly reporting any suspicious activity.

3. Dishonest Merchants

While most businesses are reputable, some may engage in unethical practices, such as overcharging or failing to provide services as promised. Always keep receipts and document your interactions to protect yourself against such occurrences.

4. Misunderstandings

Communication breakdowns can lead to billing errors or misunderstandings about payment terms. Don't hesitate to contact your creditors or service providers to clarify any discrepancies you encounter.

5. System Errors

Occasionally, automated systems used by banks or merchants experience glitches that can result in incorrect transactions. If you suspect a system error, reach out to the relevant institution for assistance.

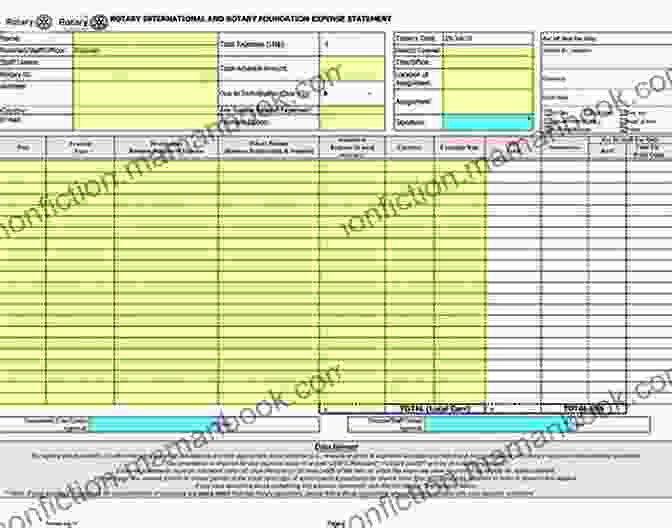

Step-by-Step Guide to Resolving Financial Discrepancies

1. Gather Your Records

Start by collecting all relevant financial documents, including bank statements, credit card bills, receipts, and invoices. Having a complete picture of your transactions will make it easier to identify the source of the discrepancy.

2. Reconcile Your Accounts

Compare your transaction records with your account balances. If you find any discrepancies, determine whether they are due to legitimate expenses that you may have forgotten about or if there are errors or fraudulent activity.

3. Contact Creditors and Merchants

If the discrepancy involves a particular transaction, reach out to the creditor or merchant directly. Provide them with the details of the transaction and request an explanation or a correction. Remain polite but assertive in your communication.

4. Report Fraudulent Activity

If you suspect fraudulent activity, contact your bank or credit card company immediately. They will likely freeze your accounts and assist you in disputing the unauthorized transactions.

5. Check Your Credit Report

Review your credit report regularly for any unauthorized activity or errors. You can request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

6. Seek Professional Help

If you are unable to resolve the discrepancies on your own, consider consulting a financial advisor or certified public accountant (CPA). These professionals can provide expert guidance and help you develop a plan to address the issue.

Additional Tips for Preventing Financial Discrepancies

1. Use Budgeting Tools

Budgeting apps and spreadsheets can help you track your expenses and keep your finances organized, reducing the likelihood of discrepancies.

2. Review Your Statements Regularly

Make it a habit to review your bank statements and credit card bills as soon as you receive them. Early detection of errors or fraudulent activity is crucial.

3. Set Up Alerts

Many banks and credit card companies offer transaction alerts that notify you of any activity on your accounts. These alerts can help you identify unauthorized transactions promptly.

4. Protect Your Data

Use strong passwords and enable two-factor authentication for all your financial accounts. Avoid sharing your personal or financial information with untrustworthy individuals or websites.

5. Educate Yourself

Stay informed about common financial scams and fraudulent activities. Knowledge is power when it comes to protecting your finances.

Addressing financial discrepancies can be a daunting task, but it is essential for maintaining the accuracy and integrity of your finances. By following the steps outlined in this handbook, you can identify and resolve these imbalances, regain control over your funds, and prevent future discrepancies. Remember, financial literacy is an ongoing journey, and seeking professional help when needed can provide valuable support in managing your financial well-being.

4.2 out of 5

| Language | : | English |

| File size | : | 8086 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 458 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Diane De Camillis

Diane De Camillis Vinicio Sanchez

Vinicio Sanchez Christina Hoag

Christina Hoag Sofia Aves

Sofia Aves Upton Sinclair

Upton Sinclair Filipe Amorim

Filipe Amorim Deepika Chamoli

Deepika Chamoli Robert Samuels

Robert Samuels Gary Greenberg

Gary Greenberg Adam Sinicki

Adam Sinicki Lilian Harry

Lilian Harry Ross Barrett

Ross Barrett Russell Sullman

Russell Sullman P A Choi

P A Choi Jorge Madriz

Jorge Madriz Dan Shaughnessy

Dan Shaughnessy Cherie Jones

Cherie Jones Christopher Charlton

Christopher Charlton Joseph Heywood

Joseph Heywood Sierra Simone

Sierra Simone

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Raymond ParkerNavigating the Delicate Balance of International Equilibrium: A Comprehensive...

Raymond ParkerNavigating the Delicate Balance of International Equilibrium: A Comprehensive...

Kyle PowellTrumpty Dumpty Black Lives Matter Edition: A Comprehensive Examination of the...

Kyle PowellTrumpty Dumpty Black Lives Matter Edition: A Comprehensive Examination of the...

Doug PriceKnitting Patterns Fit American Girl and Other 18 Inch Dolls: A Comprehensive...

Doug PriceKnitting Patterns Fit American Girl and Other 18 Inch Dolls: A Comprehensive... Caleb LongFollow ·5.2k

Caleb LongFollow ·5.2k Robert Louis StevensonFollow ·6.3k

Robert Louis StevensonFollow ·6.3k Roger TurnerFollow ·10k

Roger TurnerFollow ·10k Harvey BellFollow ·5.6k

Harvey BellFollow ·5.6k Chuck MitchellFollow ·11.5k

Chuck MitchellFollow ·11.5k Kazuo IshiguroFollow ·14.7k

Kazuo IshiguroFollow ·14.7k Evan HayesFollow ·14.6k

Evan HayesFollow ·14.6k Houston PowellFollow ·11.8k

Houston PowellFollow ·11.8k

Steve Carter

Steve CarterUnveiling the Rich Theatrical Tapestry of Russia: A...

Origins and Early...

Frank Butler

Frank ButlerOn Talking Terms With Dogs: Calming Signals and the...

For centuries, dogs have...

Leo Tolstoy

Leo TolstoyThe Inside Guide to Applying and Succeeding in...

Applying to...

Cole Powell

Cole PowellThe Political Economy of Global Finance, Farming and...

The global...

4.2 out of 5

| Language | : | English |

| File size | : | 8086 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 458 pages |