International Liquidity and the Financial Crisis

International liquidity, often referred to as global liquidity, plays a vital role in facilitating international trade and investment, and in maintaining global economic stability. It encompasses the ability of central banks, governments, and other entities to access foreign currencies and financial assets to meet their international payment obligations, such as settling trade transactions, repaying foreign debt, and intervening in foreign exchange markets.

4.7 out of 5

| Language | : | English |

| File size | : | 7273 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 386 pages |

The 2008-2009 financial crisis exposed the importance of international liquidity and highlighted its potential role in exacerbating or mitigating financial crises. This article examines the concept of international liquidity, its impact on the financial crisis, and the lessons learned that can inform policymaking and risk management strategies.

Causes and Consequences of the Financial Crisis

The financial crisis was triggered by a complex interplay of factors, including:

- Excessive risk-taking and leverage in the financial sector

- Lax lending standards and subprime mortgages

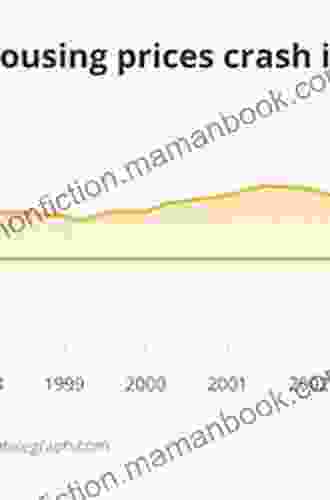

- Rising housing prices and the subsequent housing market collapse

- Interconnectedness of financial institutions and markets

The crisis created severe disruptions in international liquidity, leading to:

- A global credit crunch and reduced lending

- Sudden capital outflows from emerging markets

- Currency depreciation and instability

- Heightened risk aversion and reduced investment

International Liquidity and the Crisis

International liquidity played a multifaceted role in the financial crisis:

1. Transmission Channel

International liquidity served as a transmission channel for the crisis. The interconnectedness of financial institutions and markets meant that the financial turmoil in one country could quickly spread to others through the flow of capital. When the crisis hit, international liquidity facilitated the rapid withdrawal of funds from affected countries, exacerbating the liquidity crunch and financial instability.

2. Mitigation Mechanism

International liquidity also acted as a mitigation mechanism during the crisis. Central banks utilized their foreign exchange reserves to intervene in currency markets, stabilize exchange rates, and prevent further depreciation. The International Monetary Fund (IMF) provided emergency lending to countries facing severe liquidity shortages, helping to prevent a deeper financial meltdown.

3. Policy Dilemma

Governments and central banks faced a policy dilemma during the crisis. On the one hand, they needed to maintain sufficient international liquidity to avoid financial instability and support economic recovery. On the other hand, excessive liquidity could contribute to inflation and financial bubbles. Balancing these competing objectives was a challenging task.

Lessons Learned and Policy Implications

The financial crisis highlighted the importance of international liquidity and the need for sound policy frameworks to manage it effectively. Key lessons learned include:

- Adequate Foreign Exchange Reserves: Central banks should maintain adequate foreign exchange reserves to meet potential liquidity needs during crises.

- Coordinated Policy Response: International cooperation and coordination are essential to address liquidity shortages and prevent contagion.

- Financial Stability Framework: Robust financial stability frameworks, including macroprudential regulations and risk management practices, can help mitigate financial imbalances and reduce the likelihood of liquidity crises.

- Risk Monitoring and Early Warning Systems: Early identification and monitoring of liquidity risks are crucial for timely policy responses.

- Stress Testing: Regular stress testing of financial systems can help assess resilience to liquidity shocks.

International liquidity is a critical aspect of the global financial system, facilitating international trade and investment while also influencing macroeconomic stability. The financial crisis highlighted the importance of understanding and managing international liquidity. Policymakers and central banks should prioritize measures to enhance liquidity resilience, foster financial stability, and promote international cooperation to prevent future liquidity crises and mitigate their potential impact on the global economy.

4.7 out of 5

| Language | : | English |

| File size | : | 7273 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 386 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Gill Blanchard

Gill Blanchard Ronnee Yashon

Ronnee Yashon Margaret R Roller

Margaret R Roller Fritz Leiber

Fritz Leiber Gill Paul

Gill Paul Iris Johansen

Iris Johansen Sophie Haydon

Sophie Haydon C Fred Bergsten

C Fred Bergsten Himanshu Bhatnagar

Himanshu Bhatnagar Cherie Jones

Cherie Jones Peter Cozzens

Peter Cozzens Brennan Barnard

Brennan Barnard Margo Jefferson

Margo Jefferson Christina Hoag

Christina Hoag Daniel Donoghue

Daniel Donoghue Sir Edwin Arnold

Sir Edwin Arnold Brette Sember

Brette Sember Bradley Hope

Bradley Hope O Henry

O Henry David A Greenwood

David A Greenwood

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

George R.R. MartinThe Fight Against Organized Crime in America: Fun Facts, Trivia, and Tidbits

George R.R. MartinThe Fight Against Organized Crime in America: Fun Facts, Trivia, and Tidbits Ray BlairFollow ·19.4k

Ray BlairFollow ·19.4k Douglas FosterFollow ·3.7k

Douglas FosterFollow ·3.7k Tyler NelsonFollow ·16.6k

Tyler NelsonFollow ·16.6k Houston PowellFollow ·11.8k

Houston PowellFollow ·11.8k Yasushi InoueFollow ·4.4k

Yasushi InoueFollow ·4.4k Gordon CoxFollow ·5.8k

Gordon CoxFollow ·5.8k Raymond ParkerFollow ·11.7k

Raymond ParkerFollow ·11.7k Bryan GrayFollow ·2.2k

Bryan GrayFollow ·2.2k

Steve Carter

Steve CarterUnveiling the Rich Theatrical Tapestry of Russia: A...

Origins and Early...

Frank Butler

Frank ButlerOn Talking Terms With Dogs: Calming Signals and the...

For centuries, dogs have...

Leo Tolstoy

Leo TolstoyThe Inside Guide to Applying and Succeeding in...

Applying to...

Cole Powell

Cole PowellThe Political Economy of Global Finance, Farming and...

The global...

4.7 out of 5

| Language | : | English |

| File size | : | 7273 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 386 pages |